Cost details in Cost Details Basic Data enables you to see the unit cost of an inventory part broken down into greater detail. This enables analysis as well as posting control possibilities at a more detailed level. You could also use cost details for pricing purposes when using cost-plus contracts.

Cost detail information includes:

If you have set up the required basic data when a cost occurs, the cost detail information will be created and displayed in a cost structure. The cost structure consists of the following fields: Cost Bucket, Posting Cost Group, Cost Source and OH Accounting Year. It is the inventory part unit costs, inventory values, inventory transactions and manufacturing transactions that will display cost details in a cost structure. In case of manufactured parts, the shop order will collect all costs connected to the order and create the cost details for the manufactured part. This is illustrated by figure 1 below:

Figure1

Notes:

Cost buckets mentioned in cost detail tables are the same as cost buckets used in IFS/Costing. They define how part costs are displayed in the system and combines other lower level cost details. When cost details are generated for a part, the cost template in costing will be the base for setting the cost bucket for that transaction.

The posting cost group is a user-defined grouping of cost buckets used to create postings for a part. It is a control type in posting controls which is valid for a lot of posting types. You must first define the posting cost groups, and then connect them to cost buckets. The most common case would be to group the buckets into logical categories like material, delivery OH (overhead), labor, labor OH etc. But you could choose to group the buckets in other ways. For instance, you can group all buckets related to material (such as material, delivery OH and material OH) into one group.

It is optional to use posting cost groups. If there is no posting cost group set up, the Posting Cost Group column will always be blank. If you want, you can set the basic data to make it compulsory to use posting cost groups in the system. If this is done, you will always have to connect a cost bucket to a posting cost group.

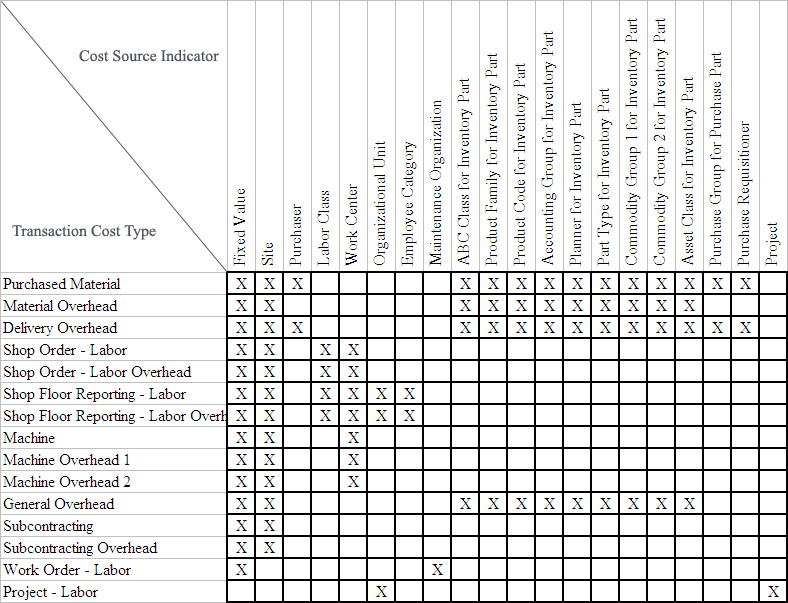

The cost source can be seen as the origin of the cost. All cost sources are user defined. For labor costs, the cost source could be a department where work is reported; for material costs, it could be a grouping of inventory parts. Costs can arise during a defined number of situations known as cost types. For each of these situations there are a number of valid cost source indicators. First you must decide the the indicator to use for a specific cost type. Then the indicator must be connected to the cost source defined by you.

Example:

However valid combination of cost source indicators are as follows:

Note: A fixed cost source must be specified only if the cost source indicator is fixed value.

It is optional to use cost sources. If there is no cost source set up, the Cost Source field will always show an asterisk sign (*). If you want, you can set the basic data to make it compulsory to use cost sources. This will make it impossible to receive a part without having a valid cost source on all cost details.

The Cost Source parameter is also a control type in the posting control valid for a lot of posting types.

The OH accounting year is the financial year when an overhead cost had been applied. This parameter is only valid for the overhead details and it is used for periodic overhead adjustments.

It is optional to use the OH Accounting Year. If there is no OH accounting year set up, the OH Accounting Year field will always show an asterisk sign (*).

Cost details for inventory part unit costs may be created through:

As mentioned earlier, when a cost occurs the cost detail information will be created and displayed within a cost structure, which may include the Cost Bucket, Posting Cost Group, Cost Source and OH Accounting Year fields.

When cost details are created through a shop order or production schedule:

When cost details are created through purchase order receipts and direct receipts into inventory:

When using standard cost per part, cost details will be created and the cost structure set, either

Note: For manufactured parts, a calculation in costing must be performed before registering the first shop order receipt.

When standard cost per part is used, the cost source and OH accounting year cannot be included in the cost structure. These fields in the cost details tables will show an asterisk sign (*).

When standard cost per condition or lot batch is used, the first receipt with that condition or lot batch will determine the cost structure for that specific condition or lot batch. If there are no parts in stock with that condition or lot batch, any receipt performed will be considered as the first receipt and a new cost structure will be generated. This is the case even if the condition or lot batch had existed in stock prior to this receipt, but the parts are not in stock at the moment.

Each receipt will be handled as a new receipt and new cost details will be created for every receipt.

A new cost structure will be defined for each new receipt, and then a new weighted average will be calculated for the parts in stock (The inventory part cost level is considered in this calculation). A new weighted average value will be calculated for each of the cost details. This is illustrated by the example below:

1) We have 10 units in stock with the following cost structure:

| Part | Race Car 1 | Total Unit Cost: | 1300 | |

| Cost Bucket | Posting Cost Group | Cost Source | OH Accounting Year | Cost |

| 110 | Material | Material Group 1 | * | 1000 |

| DOH | Delivery OH | Material Group 1 | 2005 | 300 |

2) Then 10 units are received with the following cost structure:

| Part | Race Car 1 | Total Unit Cost: | 1200 | |

| Cost Bucket | Posting Cost Group | Cost Source | OH Accounting Year | Cost |

| 110 | Material | Material Group 1 | * |

1200 |

3) New weighted averages are calculated per detail, resulting in the following cost structure for the 20 units in stock:

| Part | Race Car 1 | Total Unit Cost: | 1250 | |

| Cost Bucket | Posting Cost Group | Cost Source | OH Accounting Year | Cost |

| 110 | Material | Material Group 1 | * | 1100 |

| DOH | Delivery OH | Material Group 1 | 2005 | 150 |

Each receipt transaction will determine its own cost detail record in the FIFO/LIFO pile.

Since both the posting cost group and cost source are control types in the posting control, it will be possible to perform financial control based on these details. An inventory transaction's cost details will be stored separately. This will be the case even if no basic data for cost details are set up.

The postings are created based on the cost structure and cost details information. The usual case is that only one pair of postings is created per transaction. If you have set up cost details, one pair of postings will be created per combination of posting cost group and cost source. This is illustrated below for the transaction cost of a material requisition issue (INTSHIP) for 1 unit.

| Transaction | INTSHIP | Part No: | RC1 | Total Trans Cost: | 1300 |

| Cost Bucket | Posting Cost Group | Cost Source | OH Accounting Year | Cost | |

| 110 | * | * | 1000 | ||

| DOH | * | * | 300 | ||

| Transaction | INTSHIP | Total Trans Cost: | 1300 | |

| Posting Type | Posting Cost Group | Cost Source | Debit/Credit | Cost |

| INTSHIP | D - M53 | 1300 | ||

| INTSHIP | C - M1 | 1300 |

Notice that if there is no cost source setup, the Cost Source field of cost details for the transaction shows an asterisk (*). But the Cost Source field on the posting lines will be blank.

| Transaction | INTSHIP | Part No: | RC1 | Total Trans Cost: | 1300 |

| Cost Bucket | Posting Cost Group | Cost Source | OH Accounting Year | Cost | |

| 110 | Material | Material Group 1 | * | 1000 | |

| DOH | Delivery OH | Material Group 1 | 2005 | 300 | |

| Transaction: | INTSHIP | Total Trans Cost: | 1300 | |

| Posting Type | Posting Cost Group | Cost Source | Debit/Credit | Cost |

| INTSHIP | Material | Material Group 1 | D - M53 | 1000 |

| INTSHIP | Material | Material Group 1 | C - M1 | 1000 |

| INTSHIP | Delivery OH | Material Group 1 | D - M53 | 300 |

| INTSHIP | Delivery OH | Material Group 1 | C - M1 | 300 |